CA/CMA Final – Direct Tax DT Practical Question Batch by CA Aarish Khan for Sep 25 & Jan 26 onwords

₹2,999.00 – ₹4,499.00Price range: ₹2,999.00 through ₹4,499.00

ADDITIONAL 5% DISCOUNT USE CODE – FLAT 5%

CA Aarish Khan – CA/CMA Final – Direct Tax DT Practical Question Batch

For Sep 25 & Jan 26 onwords

| Faculty Name | CA Aarish Khan |

| Course Level | CA / CMA Final |

| Subject | Direct Tax Laws (New Scheme) |

| Duration In Hours | 40 Hrs. Approx. |

| Batch Type | DT Practical Question Batch | Practice Batch |

| Video Language | HINDI - ENGLISH MIX | FULL ENGLISH |

| Attempt | Sep 25 & Jan 26 onwords |

| Lecture Recording Date | Latest Recordings |

| Books | HardCopy & SoftCopy |

| Topics Covered | 1. All ICAI Case Laws will be taught in the class itself 2. All ICAI MCQs will be discussed online |

| No. Of Views | 1.5 Views |

| Validity | Unlimited |

| Validity Start From | From the date of Activation |

| Amendments | If Any Will be uploaded on Youtube |

| Fast Forward Speed | Upto 2x |

| Video Runs On | Window Laptop and Android Mobile |

| Revision Videos | Revision Videos for Complete Syllabus on YouTube |

| System Requirement | System Requirement Windows Laptop/Desktop – Windows 8 and above and 4 GB RAM. Android Version 7.0 and above, minimum RAM 4GB, Phone should have good performance. iPhone Requires iOS 12.1 or later. MAC Laptop Doesn’t Support. |

| Processing Time | Within 24 to 48 Working Hours |

- The batch will be approximately – 40 Hours.

- We will explain conceptually more than 450 Questions in class.

- We will explain Past 8 Attempt RTP’s, 8 MTP’s & 8 Exam Papers also.

- We will also explain special questions on Finance Act 2024 amendments.

- We will also explain new course topic questions like Tax Audit, Black Money Law.

- All Questions are classified in to 3 different star ⭐️ categories. (3⭐️, 4⭐️, 5⭐️)

- All questions should be first read by students and Aarish Sir will explain each and every point in detail. Aarish sir may not read the questions. Questions should be read by students themselves.

- This batch is recommended to those students who have not practiced enough questions in their respective lectures.

- Student have option to choose books, only Question Bank or Question Bank with Easy Notes Coloured book along with the lecture.

CA Aarish Khan, the founder of Aarish Khan Classes, began his teaching career in 2012, achieving the highest All-India score in the Taxation Paper of his CA Final Exams. With over a decade of experience, he specializes in Direct Tax, International Taxation (Elective Paper), he has also taught subjects like Indirect Taxes, Financial Management, and Mathematics. As both an educator and a practicing Chartered Accountant, Aarish brings real-world insights into his teaching.

Having taught over 100,000 students across India, he is known for his unique approach that emphasizes understanding the core logic behind tax provisions rather than rote memorization. His philosophy, "If you know why, you’ll know how," encourages practical application of knowledge.

Aarish provides students with his popular Coloured NOTES and Revision Videos, which are highly appreciated for last-minute preparation. His dedication to student success is reflected in his constant availability to clarify doubts, making him a trusted mentors in India.

Related products

CA Final – Financial Reporting FR (Fastrack – Exam Oriented Batch) by CA Aakash Kandoi for Sep 25 & onwards

CA Final – AFM (Regular Batch) LIVE by CA Sankalp Kanstiya for Sep 25 & Jan 26 Onwards

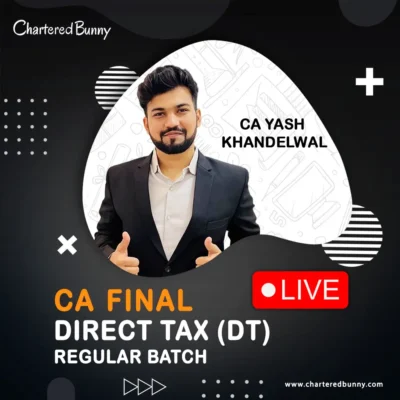

CA Final – Direct Tax DT (Regular Batch) by CA Yash Khandelwal for Sep 25 & Jan 26

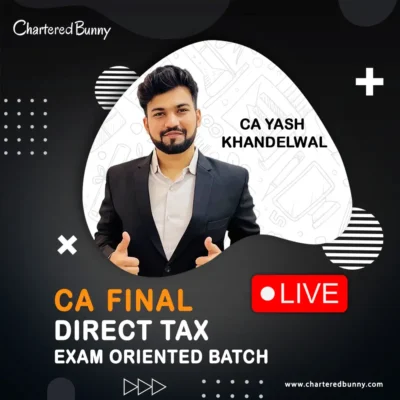

CA Final DT – Direct Tax (Exam Oriented Batch) LIVE by CA Yash Khandelwal for Sept 25 & Jan 26

CA/CMA Final – Direct Tax Laws (Smart Notes, Question Bank & Khazana Notes) by CA Yash Khandelwal for Sep 25 / June 25 /Dec 25 & Jan 26 Exams

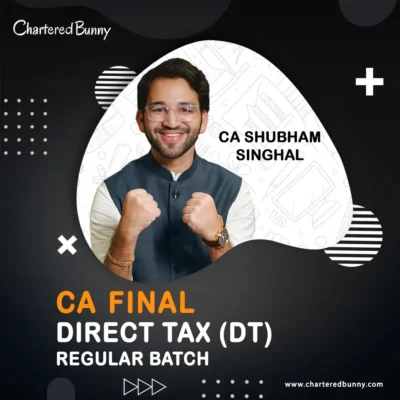

CA/CMA Final – Direct Tax Regular Batch by CA Shubham Singhal for Sep 25 & Jan 26

CA Final – DT & SPOM Law Regular Batch by CA Shubham Singhal for May 25 & Nov 25