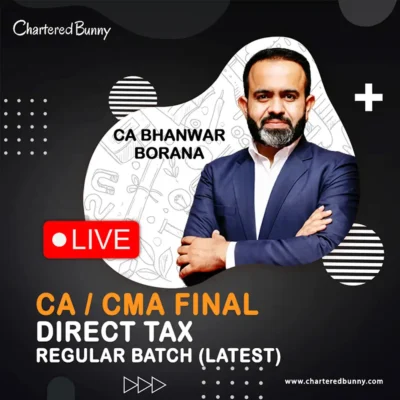

CA/CMA Final – Direct Tax (New Regular Batch) by CA Bhanwar Borana for Dec 2025 & Jan 26

₹13,999.00 – ₹14,999.00Price range: ₹13,999.00 through ₹14,999.00

CA Bhanwar Borana – Direct Tax (New Regular Batch) for CA/CMA Final – June 25, Sep/Dec 25 & Jan 26

Latest Batch New Recordings

Date of Commencement – 5th August 2024

Date of Completion – 15st November 2024

As per New Syllabus of ICAI

| Language | Hindi - English Mix |

| Demo | WATCH NOW |

| Backup | 100% Backup |

| No of lectures | 84 Lectures Approx |

| Duration | 253 hours Approx |

| Recordings | Latest - Nov 2024 |

| Validity | 1 Year from the date of Activation |

| Views | 1.5 Times |

| Study Material | Bare Act Provision Book / Compact 3.0 / Q & A Compiler |

| Note by BBvirtuals | Order once placed cannot be Cancelled |

Founder of BB Virtuals, CA Bhanwar Borana, is a highly respected educator with over 10 years of experience in CA Final Direct Tax (DT) and International Taxation exams. With more than 300 ranks in CA under his guidance, Bhanwar Sir has earned a reputation as one of the leading instructors in the CA community. His expertise in CA Final DT and Direct Tax makes him a sought-after lecturer at ICAI and other taxation platforms.

A comprehensive online learning platform designed specifically for CA and CMA aspirants. The platform brings together top-notch faculty, handpicked by Bhanwar Sir, to ensure that students receive the best guidance in CA Final DT and Direct Tax subjects. Under his mentorship, students are not just taught but are also inspired and motivated to achieve their goals. With over 10 years of teaching experience and a track record of 300+ ranks in CA, Bhanwar Borana’s guidance helps students excel in CA Final DT and other professional courses.

Whether you’re preparing for CA Final DT Bhanwar Borana classes or looking for expert Direct Tax Bhanwar Borana courses, BB Virtuals offers the best online resources to help you clear your CA Final Direct Tax exams with confidence.

Simultaneous login on Android App and Laptop is permitted After you log out from the other device. For Eg. If you have activated in Android and now you wish to watch the lectures in Laptop, You just have to Log out of the application in Android and Login in the application in Laptop.

Live At Home will only work on Laptop with Windows 10,11 or above. (Minimum 10MBPS Speed with Wifi Connection) or Android version 7.0 or higher

For Google Drive & Pendrive

1. It can be played only on LAPTOP with Windows 10,11 or any other higher version.

For Mobile (Android ONLY)

1. Android version 7.0 or higher will be required.

2. 3 GB Ram & 32 GB Internal Memory At least will be Required

Founder of BB Virtuals, CA Bhanwar Borana has given 300+ ranks in CA and gives regular lectures at ICAI and various taxation platforms with 10 years of teaching experience in IPCC and Final Direct and International Taxation exams.

BB Virtuals is a one-stop online learning platform for CA aspirants. Founded in 2017 by CA Bhanwar Borana, BB Virtuals brings you the best Professors for professional degrees like CA & CMA. Handpicked by CA Bhanwar Borana, our faculty ensures that your concepts are clear, and learning is fun. With a teaching experience of over 10 years and 300+ ranks in CA under his guidance, CA Bhanwar Borana tries to help his students achieve their dreams and goals by donning multiple hats of a guide, teacher, mentor, motivator, and most importantly, a friend.

Related products

CA/CMA Final – Direct Tax (Regular Batch) by CA Bhanwar Borana for May/June 26, Sep/Dec 26 & Jan 27

CA/CMA Final – DT (Exam Oriented – Fastrack Batch) by CA Bhanwar Borana for Dec 25 & Jan 26 Full English

CA Final – AFM Regular Batch Advanced Financial Management by CA Aaditya Jain (New Syllabus)

₹15,499.00 – ₹18,499.00Price range: ₹15,499.00 through ₹18,499.00

CA Final – Financial Reporting (FR) Regular Batch Full Course by CA Parveen Jindal for Jan 26, May 26 & onwords

CA Final – Direct Tax DT (Regular Batch) by CA Yash Khandelwal for Jan 26